5 Steps to Buy Your First Real Estate Property: A daunting journey, perhaps, but one filled with the promise of a future home, a place to build memories, a sanctuary from the storm. This path, though challenging, is paved with careful planning, informed decisions, and a touch of hope. Navigating the complexities of mortgages, agents, and offers can feel overwhelming, but understanding each step brings you closer to realizing the dream of homeownership.

This guide illuminates the way, offering a roadmap through the often-treacherous terrain of the real estate market.

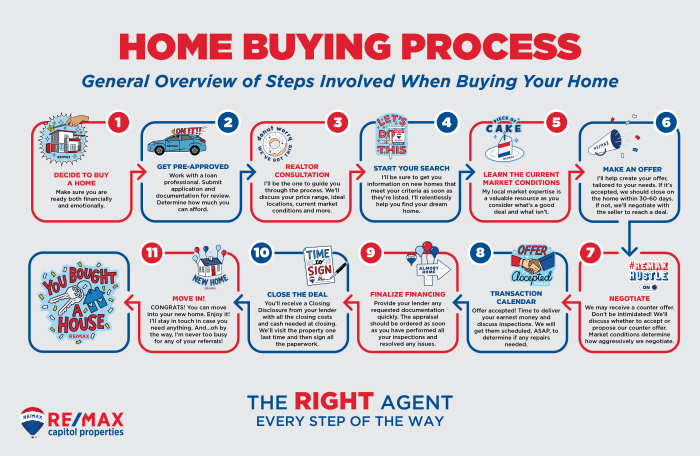

The process of buying your first home is a significant undertaking, a blend of excitement and apprehension. Financial preparedness lays the foundation, determining your affordability and securing the necessary funds. Finding the right real estate agent is crucial; their expertise can be invaluable in navigating the complexities of the market. The search for the perfect property, the thrill of making an offer, the securing of financing—each step carries its own weight of anticipation and potential disappointment.

Finally, the closing, a culmination of efforts, marks the beginning of a new chapter. This journey is a testament to perseverance, a reminder that the rewards of homeownership are worth the effort.

Determine Your Financial Readiness

Buying your first home is a significant financial undertaking. Before even browsing listings, it’s crucial to assess your financial health and determine your affordability. This involves understanding your credit score, calculating your potential mortgage payment, saving diligently for a down payment and closing costs, and choosing the right mortgage type.

Credit Score Assessment and Improvement

Your credit score is a critical factor in securing a mortgage. Lenders use it to assess your creditworthiness and determine the interest rate you’ll qualify for. A higher credit score translates to better interest rates and more favorable loan terms. Check your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) for free annually at AnnualCreditReport.com.

If your score needs improvement, focus on paying down debt, paying bills on time, and maintaining low credit utilization (the amount of credit you use relative to your total available credit).

Calculating Affordable Monthly Mortgage Payments

Determining how much you can comfortably afford to pay each month is vital. A good rule of thumb is to keep your total housing costs (mortgage payment, property taxes, homeowner’s insurance, and potentially private mortgage insurance (PMI)) below 28% of your gross monthly income. This is often referred to as the front-end debt ratio. Additionally, your total debt payments (including housing costs and other loans) shouldn’t exceed 36% of your gross monthly income (back-end debt ratio).

You can use online mortgage calculators to estimate your monthly payment based on loan amount, interest rate, and loan term. For example, a $300,000 mortgage at 7% interest over 30 years might result in a monthly principal and interest payment of approximately $2,000. Remember to factor in additional costs like property taxes and insurance to get a complete picture.

Saving for a Down Payment and Closing Costs

Saving for a down payment and closing costs requires discipline and planning. The down payment is the upfront cash payment you make toward the purchase price of the home, typically ranging from 3% to 20% or more. Closing costs cover various expenses associated with finalizing the home purchase, such as appraisal fees, title insurance, and loan origination fees.

These costs can add up to several thousand dollars. Create a detailed budget to track your income and expenses, identifying areas where you can cut back. Explore additional income sources such as part-time jobs, freelance work, or selling unused items. Consider setting up an automatic transfer to a dedicated savings account each month to ensure consistent savings.

Mortgage Type Comparison

Choosing the right mortgage is crucial. Different types of mortgages have varying interest rates, terms, and requirements.

| Mortgage Type | Interest Rate | Down Payment | Pros | Cons |

|---|---|---|---|---|

| Fixed-Rate | Fixed for the loan term | Variable | Predictable payments, stability | Potentially higher initial interest rates |

| Adjustable-Rate (ARM) | Changes periodically | Variable | Potentially lower initial interest rates | Payment uncertainty, risk of rising rates |

| FHA | Variable | Lower down payment requirements (as low as 3.5%) | Easier qualification for first-time buyers | Mortgage insurance premiums |

| VA | Variable | Often no down payment required | Excellent option for eligible veterans | Funding fee |

Find a Real Estate Agent: 5 Steps To Buy Your First Real Estate Property

Navigating the complex world of real estate transactions, especially for first-time buyers, can feel overwhelming. A skilled real estate agent acts as your guide, providing invaluable expertise and support throughout the process, ultimately helping you secure the best possible deal. Choosing the right agent is a crucial step that can significantly impact your success.Securing a buyer’s agent offers several key advantages.

Their intimate knowledge of the local market, including current pricing trends, neighborhood characteristics, and comparable properties (comps), is indispensable. Beyond market analysis, a buyer’s agent acts as a skilled negotiator, advocating for your best interests and ensuring you achieve a fair price. Their experience in navigating complex paperwork and legal procedures also provides significant peace of mind. They can identify potential issues early on, saving you time, money, and stress.

Agent Selection Process

Selecting a real estate agent requires careful consideration. The process should begin with identifying several potential agents whose profiles align with your needs and preferences. Thorough interviews are essential to assess their experience, communication style, and overall suitability. This involves asking pointed questions to gauge their understanding of your specific requirements and their approach to problem-solving. Checking references from past clients provides valuable insight into their professionalism and client satisfaction.

This due diligence ensures a strong working relationship built on trust and effective communication.

Agent Compensation Models, 5 Steps to Buy Your First Real Estate Property

Real estate agents are typically compensated through commissions, which are usually a percentage of the final sale price. The commission is typically paid by the seller, not the buyer. However, it’s crucial to understand how the commission structure works and its potential implications. Some agencies may have a flat fee structure or offer different commission rates depending on the property type or price range.

Understanding these variations ensures you’re aware of all associated costs. For instance, a higher commission percentage may not necessarily translate to superior service, and a lower commission might not indicate compromised quality. The key is finding an agent whose skills and experience justify their compensation.

Essential Questions for Potential Agents

Before committing to an agent, preparing a list of essential questions is crucial. These questions should cover their experience, market knowledge, communication style, and negotiation strategies. For example, inquiring about their average transaction time, their familiarity with the specific neighborhoods you’re targeting, and their approach to handling challenging situations will provide valuable insights. Asking about their marketing strategies if you intend to sell your property in the future can also be beneficial.

Furthermore, inquiring about their network of contacts, such as mortgage lenders and inspectors, will help assess their capacity to provide comprehensive support throughout the buying process. A clear understanding of these aspects will empower you to make an informed decision and select the best agent for your needs.

Search for Properties and Make an Offer

Buying your first property is an exciting yet complex process. After determining your financial readiness and securing a real estate agent, the next crucial step involves actively searching for suitable properties and formulating a compelling offer. This stage requires a strategic approach, combining online research with informed decision-making.This section will guide you through the process of identifying potential properties, navigating online listings, conducting virtual tours, and crafting a strong offer that increases your chances of a successful purchase.

Understanding the market, your priorities, and negotiation strategies are key to navigating this phase effectively.

Identifying Suitable Properties

Finding the right property involves carefully considering location, budget, and desired features. Start by defining your non-negotiables – these are the features you absolutely must have in a property (e.g., number of bedrooms, proximity to work or schools, specific amenities). Then, consider your “nice-to-haves” – features that would be desirable but aren’t essential. Using online real estate portals, refine your search based on these criteria.

For example, if your budget is $300,000 and you need at least three bedrooms and a garage within a 10-mile radius of your workplace, your search filters should reflect these specifications. Remember to also consider the future; will this property meet your needs in 5 or 10 years?

Navigating Online Property Listings and Virtual Tours

Most property searches begin online. Familiarize yourself with popular real estate websites and apps. Utilize advanced search filters to narrow down your results efficiently. Pay close attention to property descriptions, high-quality photos, and virtual tours. Virtual tours offer a preliminary assessment of the property’s layout, condition, and overall feel.

While they cannot replace an in-person viewing, they help you eliminate unsuitable properties quickly. Note down any questions or concerns that arise during the virtual tour to discuss with your real estate agent before scheduling an in-person viewing. For example, a blurry photo of a crucial area might indicate a problem that warrants further investigation.

Negotiating a Property Offer

Making an offer involves a delicate balance of assertiveness and realism. A strong offer demonstrates your seriousness without being unrealistic. A weak offer might be easily rejected. For instance, offering significantly below the asking price without justification is a weak tactic. Conversely, a strong offer might be slightly below the asking price but is backed by a pre-approval letter demonstrating your financial capacity and a swift closing timeline.

Your real estate agent will play a vital role in guiding you through this process, advising you on the market value and appropriate offer price based on comparable properties. Always remember to remain professional and courteous throughout the negotiation process.

Factors to Consider When Making an Offer

Making an offer involves more than just the price. Several crucial factors must be considered to ensure a smooth transaction.

- Offer Price: Research comparable properties (comps) to determine a fair market value and structure your offer accordingly.

- Earnest Money Deposit: This demonstrates your commitment and is typically held in escrow until closing.

- Contingencies: These are conditions that must be met before the sale is finalized (e.g., financing contingency, appraisal contingency, inspection contingency).

- Closing Date: Negotiate a realistic closing date that aligns with your financial and logistical arrangements.

- Inspection Period: Secure sufficient time to conduct a thorough home inspection to identify any potential issues.

A well-structured offer demonstrates seriousness and professionalism, increasing your chances of a successful purchase.

Secure Financing and Get Pre-Approved

Securing financing is a crucial step in the home-buying process. Pre-approval for a mortgage significantly strengthens your offer and demonstrates your seriousness to sellers. Understanding the process, comparing lenders, and interpreting loan agreements are essential for a smooth transaction and securing the best possible terms.Getting pre-approved involves a thorough assessment of your financial situation by a mortgage lender.

This process helps you determine how much you can realistically borrow and allows you to shop for properties within your budget confidently.

Mortgage Pre-Approval Process and Required Documentation

The pre-approval process typically begins with an application. Lenders will require extensive documentation to verify your income, credit history, and assets. This usually includes pay stubs, tax returns, bank statements, and proof of employment. They will also pull your credit report to assess your creditworthiness, checking for factors like credit score, debt-to-income ratio (DTI), and history of loan repayments.

The lender will then analyze this information to determine your eligibility for a mortgage and the loan amount they are willing to offer. The entire process can take several days to a few weeks, depending on the lender and the complexity of your financial situation.

Comparison of Mortgage Lenders and Their Terms

Various lenders offer mortgages, including banks, credit unions, and online lenders. Each lender has its own criteria for approval, interest rates, and fees. Banks often offer a wide range of products but may have stricter requirements. Credit unions may offer more competitive rates to their members, while online lenders can streamline the application process but might have higher fees.

Interest rates fluctuate based on market conditions and the lender’s risk assessment. Fees can include origination fees, appraisal fees, and closing costs. It’s vital to compare the Annual Percentage Rate (APR), which reflects the total cost of the loan, including interest and fees, to get a comprehensive understanding of the overall cost. For example, one lender might offer a lower interest rate but higher fees, resulting in a higher APR than a lender with a slightly higher interest rate but lower fees.

Importance of Shopping Around for Mortgage Rates and Terms

Shopping around for the best mortgage rates and terms is crucial to saving money over the life of the loan. Even small differences in interest rates can translate into significant savings over the long term. For example, a 0.5% difference in interest rate on a $300,000 mortgage over 30 years can amount to tens of thousands of dollars in interest payments.

By comparing offers from multiple lenders, you can ensure you are securing the most favorable terms for your individual circumstances. This includes not only interest rates but also fees, loan terms, and any additional features offered.

Understanding and Interpreting Mortgage Loan Agreement Terms

The mortgage loan agreement is a legally binding contract outlining the terms and conditions of your loan. It’s essential to thoroughly review and understand all clauses before signing. Key terms to focus on include the interest rate, loan term (amortization period), monthly payment amount, and any prepayment penalties. The agreement will also detail the loan-to-value ratio (LTV), which is the percentage of the home’s value that is financed by the mortgage.

A lower LTV typically results in better loan terms. Understanding these terms empowers you to make informed decisions and avoid potential pitfalls. If anything is unclear, consult with a financial advisor or legal professional before signing.

Close the Deal

The final stage of buying your first property, closing the deal, can feel overwhelming, but with careful planning and preparation, it can be a smooth and successful process. This involves several key steps, from the final walkthrough to the official transfer of ownership. Understanding each stage will help minimize stress and ensure a positive outcome.The closing process brings together all the loose ends of your real estate transaction.

It’s the culmination of weeks, perhaps even months, of searching, negotiating, and securing financing. This stage requires meticulous attention to detail and a clear understanding of the legal and financial implications.

Final Walkthrough

Before signing any documents, conduct a thorough final walkthrough of the property. This is your last chance to identify any discrepancies between the property’s condition at the time of offer and its current state. Check appliances, fixtures, and systems, ensuring everything is in working order as agreed upon. Note any damages or repairs needed and communicate these to your real estate agent immediately.

Addressing issues before closing prevents potential disputes later.

Signing Documents

The closing itself involves signing a significant amount of paperwork. This includes the deed, mortgage documents (if applicable), and other legal agreements. Take your time to review each document carefully, and don’t hesitate to ask your real estate agent or lawyer to clarify anything you don’t understand. Signing without fully comprehending the documents could have serious legal and financial consequences.

Transferring Ownership

Once all documents are signed and funds are transferred, ownership of the property officially changes hands. This is a significant milestone, marking the successful completion of your real estate purchase. You’ll receive the keys and can begin the exciting process of moving in and making the property your own.

Managing Stress and Paperwork

The sheer volume of paperwork and legal jargon can be daunting. To manage stress, organize your documents, create a checklist of tasks, and seek support from your real estate agent and lawyer. They are your allies in navigating this complex process. Breaking down the process into manageable steps and celebrating each milestone can also significantly reduce stress levels. Remember, thorough preparation is key to a smoother closing.

Reviewing Closing Documents

Thoroughly reviewing all closing documents before signing is paramount. This includes the closing disclosure, which Artikels all costs associated with the transaction. Verify all figures and ensure they align with your understanding of the agreed-upon terms. Any discrepancies should be addressed immediately with your agent and/or lawyer. Don’t feel pressured to sign anything you don’t fully understand.

Typical Real Estate Closing Process Timeline

A typical real estate closing process can be visualized as a linear timeline. It begins with the acceptance of your offer, followed by the appraisal and inspection periods. Next comes the loan approval, followed by the final walkthrough. Then comes the signing of the closing documents, and finally, the transfer of ownership and the receipt of the keys. Each stage has a typical duration, but unforeseen delays can occur, potentially extending the overall timeline. The entire process, from offer acceptance to closing, can range from 30 to 60 days, or even longer, depending on various factors including loan processing times and the complexity of the transaction. A well-organized timeline, preferably visually represented with a flowchart, can greatly assist in managing expectations and ensuring a smooth closing.

Conclusive Thoughts

The dream of owning a home, once a distant aspiration, becomes tangible through careful planning and informed action. Each step—from assessing financial readiness to navigating the closing process—requires diligence and attention to detail. While the journey may present challenges, the ultimate reward—the key to your own front door—makes the effort worthwhile. Remember that even amidst the complexities and potential setbacks, the pursuit of homeownership is a journey of hope, a testament to the enduring human desire for a place to call home, a place of comfort and belonging.

The path may be winding, but the destination promises solace and peace.

User Queries

What credit score is needed to buy a house?

While lenders vary, a score above 620 generally improves your chances of approval for a conventional loan. Higher scores often lead to better interest rates.

How much should I put down on a house?

A 20% down payment avoids private mortgage insurance (PMI), but smaller down payments are possible with FHA or VA loans, though they might involve higher interest rates or other fees.

What are closing costs, and how much should I expect to pay?

Closing costs cover various fees associated with finalizing the purchase, typically 2-5% of the loan amount. These include appraisal fees, title insurance, and loan origination fees.

How long does the entire home-buying process typically take?

The process can range from a few weeks to several months, depending on market conditions, financing, and the complexity of the transaction.

Can I negotiate the price of a house?

Absolutely. Negotiation is a common part of the process. Your agent can advise you on making a competitive offer, considering market value and the condition of the property.